Pandemic drives seafood online

Jen Levin is revolutionizing New England’s seafood industry—in more ways than one. The President and CEO of True Fin, a new Portland, Maine-based seafood wholesaler, is directly connecting local fish harvesters with restaurants and generating better prices through an obsession with quality. Her radical mission is to rejuvenate the floundering groundfish industry, suppressed by years of poor catches, low prices, and cheap imports.

“We had no intention of doing anything e-commerce when we created our company. We were one hundred percent wholesale,” she said. “It was the pandemic that forced us to think about how to sell directly to home cooks.”

When pandemic lockdowns cut off her restaurant customers, she quickly relaunched her website on WooCommerce, an online platform to take orders, manage inventory and invoice consumers directly. True Fin quickly became a direct-to-consumer (D2C) business and Levin an unwitting digital pioneer.

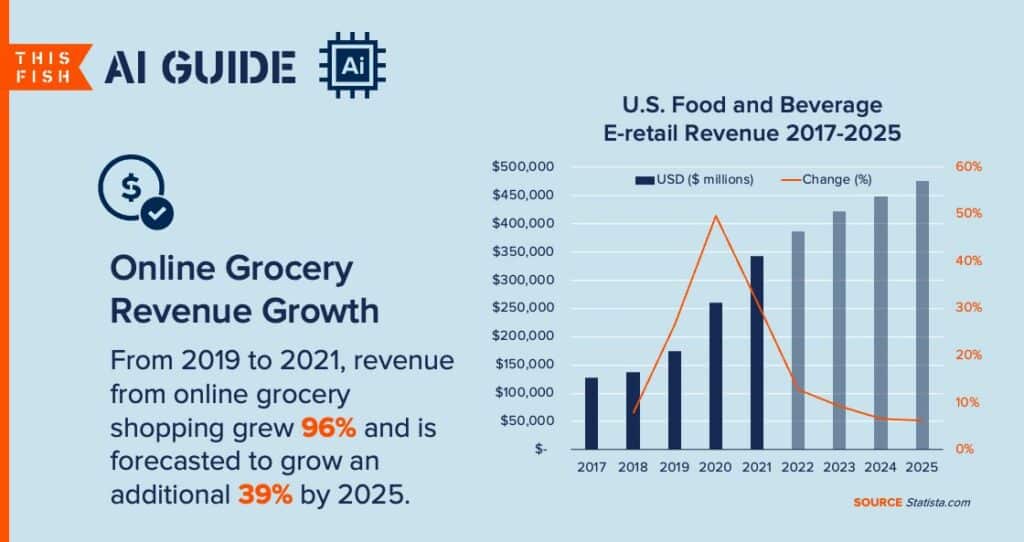

“COVID-19 massively accelerated trends that we were already seeing—it packed a decade of e-commerce growth into a single year,” reports Shopify, the e-commerce platform. “Homebound consumers dramatically changed their shopping behavior, and millions of businesses were forced to invest more heavily in their existing e-commerce channels or go online for the first time.”

Indeed, many businesses experienced the advantages of digital for the first time during the pandemic. “The e-commerce platform was a huge improvement over email, Excel and individually invoicing people via QuickBooks—all manual processes,” Levin says.

Then came the pandemic.

“It was almost like we jumped off a cliff,” Levin recalls of how home-cook sales collapsed as more people were vaccinated and social distancing restrictions were lifted. “People didn’t have the time and space to do a local parking-lot pickup for their two to four pounds of fish for that week.”

Levin then did yet another digital pivot. She relaunched the company’s website on Shopify, a platform which has better integration with third party logistics (3PL) services for home delivery.

Yet the D2C market quickly became crowded, as many companies pivot to D2C driving up customer acquisition costs. That led Levin to yet a third pivot: wholesaling to other online shopping platforms such as e-Fish, Real Good Fish, Luke’s Lobster and others that specialize in online marketing and fulfilment directly to consumers.

Enabling supply chain interactions

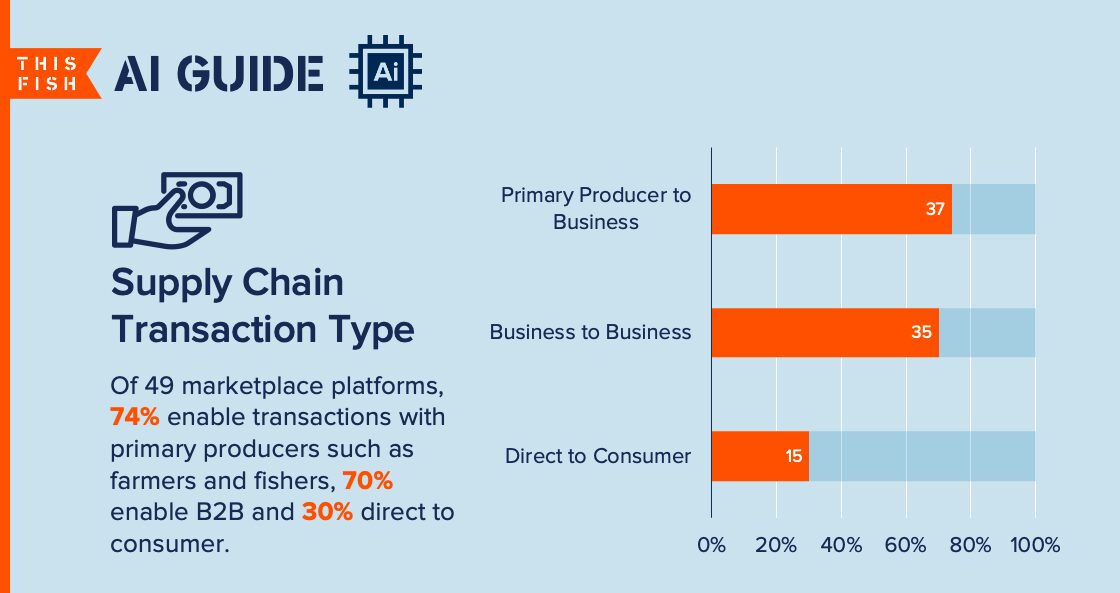

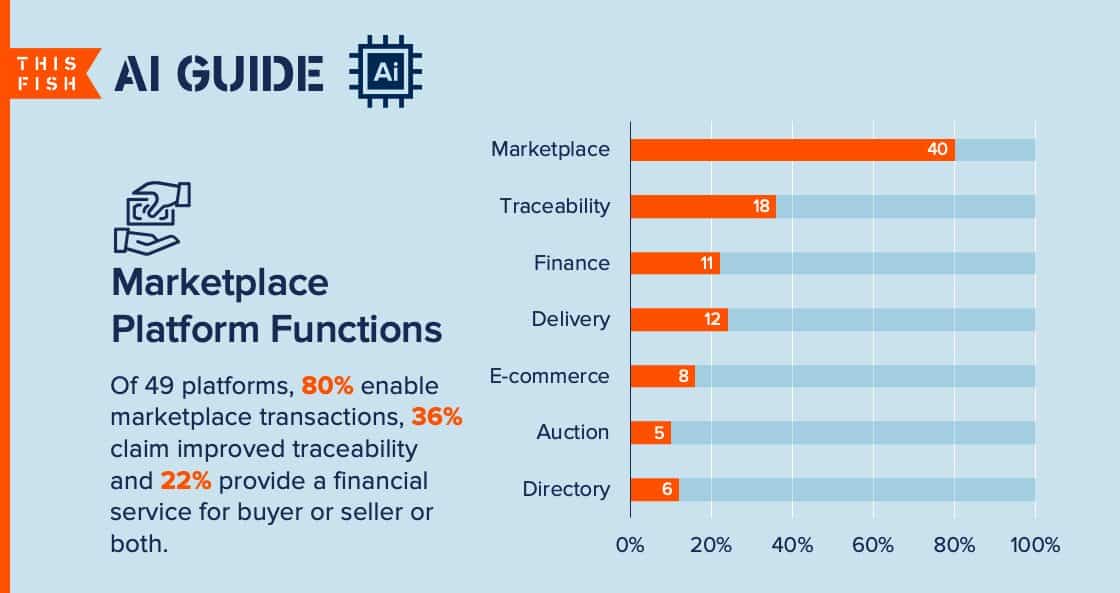

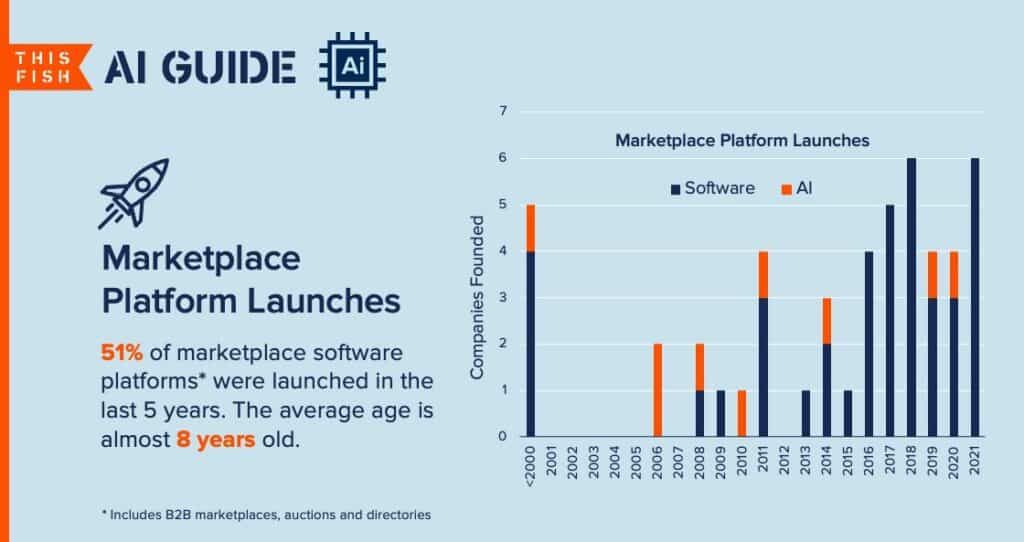

Levin’s story represents the tumultuous market dynamics over the last two years. Many companies nimbly piloted and pivoted new digital technologies. Indeed, we surveyed 49 digital marketplace platforms used by seafood companies and more than half were launched in the last five years.

These online marketplaces enable B2B and D2C transactions, and 75 percent also help facilitate transactions with fish harvesters and farmers. The latter category includes online auctions such as LegitFish and Tuna Solutions or online brokering and financial services for shrimp farmers such as AquaConnect, XpertSea and eFishery.

Seafood workflows require specialized software

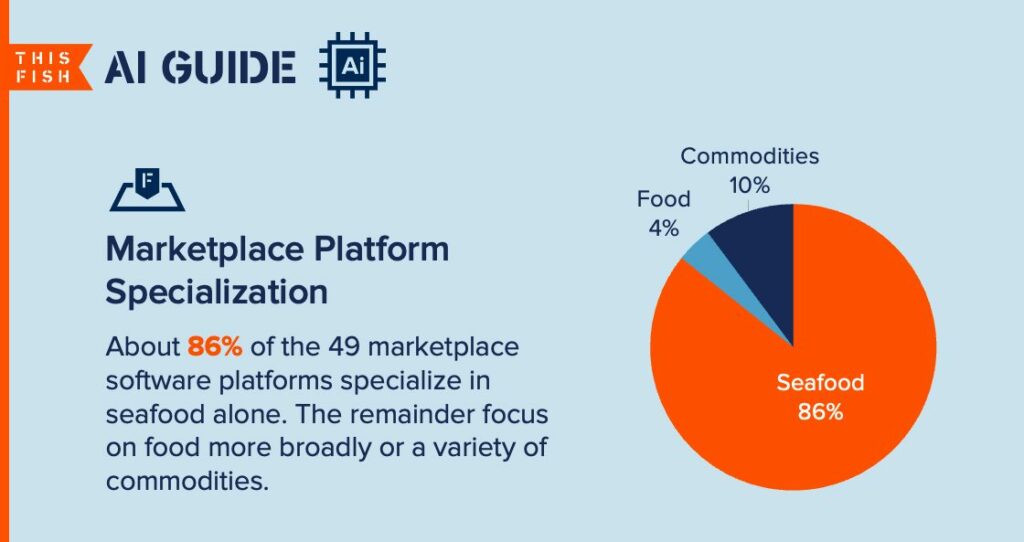

In surveying these platforms, one thing becomes clear: Seafood is special. Indeed, 86% of the 49 platforms are focused on seafood alone. About 10 percent are e-commerce apps for generalized buying and selling, such as Shopify, Amazon, WooCommerce and BigCommerce.

Robert Kirstiuk, Co-Founder and CEO of Freshline, knows how specialized the industry is. In 2016, he launched his company to digitize and shorten supply chains between producers and high-end restaurants. Freshline started in the Vancouver market, initially with local fishermen, and then expanded to suppliers in Alaska, Vietnam and Japan.

“We built that business up to the mid seven figures annually and then the pandemic hit,” says Kirstiuk.

Like True Fin, Freshline needed to pivot for survival. They experimented with D2C sales but decided on a different path. Half their employees were engineers who had effectively built software to automate their internal buying and selling workflows. “We really codified every part of the supply chain,” says Kirstiuk.

Seafood wholesalers were now desperate to get online to tap the D2C market and Freshline had the solution. Kirstiuk quickly turned crisis into opportunity. He quickly relaunched Freshline as a software company, selling its online marketplace platform to former wholesale competitors.

Growing revenue with greater efficiency

Freshline had a clear competitive advantage over their big e-commerce rivals such as Shopify and WooCommerce: they had already built many features unique to seafood wholesaling such as the ability to sell products with variable weights, dynamically calculate shipping costs and enable complex pick-and-pack workflows.

Freshline initially built the platform for D2C, but then quickly enabled B2B wholesale ordering where Kirstiuk sees the largest growth potential. Gen Z and Millennial chefs prefer online ordering and so he expects online wholesale orders to overtake D2C by the end of 2022.

Online marketplaces have two primary value propositions: First, they provide an opportunity for traditional wholesalers to diversify and grow revenues through new D2C and new B2B channels. Second, software can make the entire sales, ordering, fulfilment, and logistics process more efficient.

In fact, prior to the pandemic, Freshline had reached 70 percent of its wholesale customers ordering online. That enabled major efficiency gains. According to Kirstiuk, the average sales rep manages up to 50 accounts. Freshline reached 200.

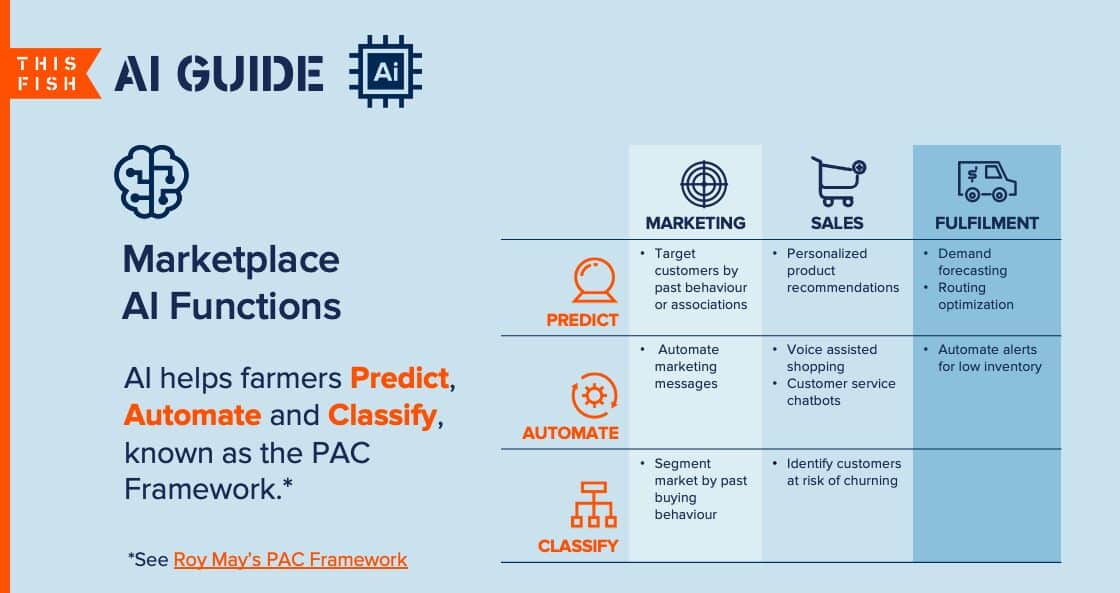

There’s one area where Freshline doesn’t have a competitive advantage over goliaths such as Amazon and Shopify: artificial intelligence. The big e-commerce platforms have been using AI for more than a decade for product recommendations, routing optimization for delivery and even customer support. Only 18 percent of online marketplaces are using AI, but there’s a lot of opportunity for growth.

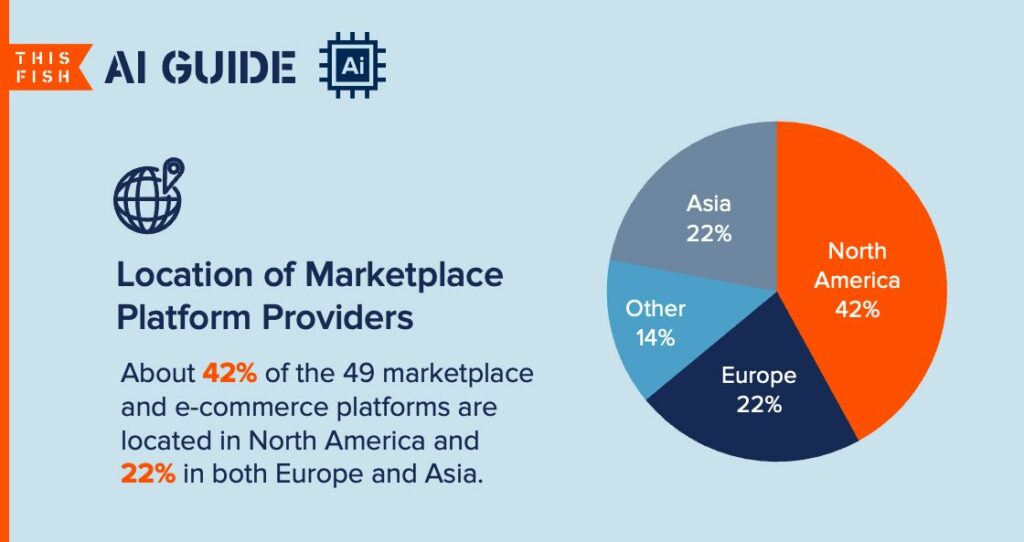

“The great thing about AI is that it is becoming more and more accessible,” says Kirstiuk. That’s true about technology in general. Online marketplaces are growing in every regional of the world.

Online marketplaces growing worldwide

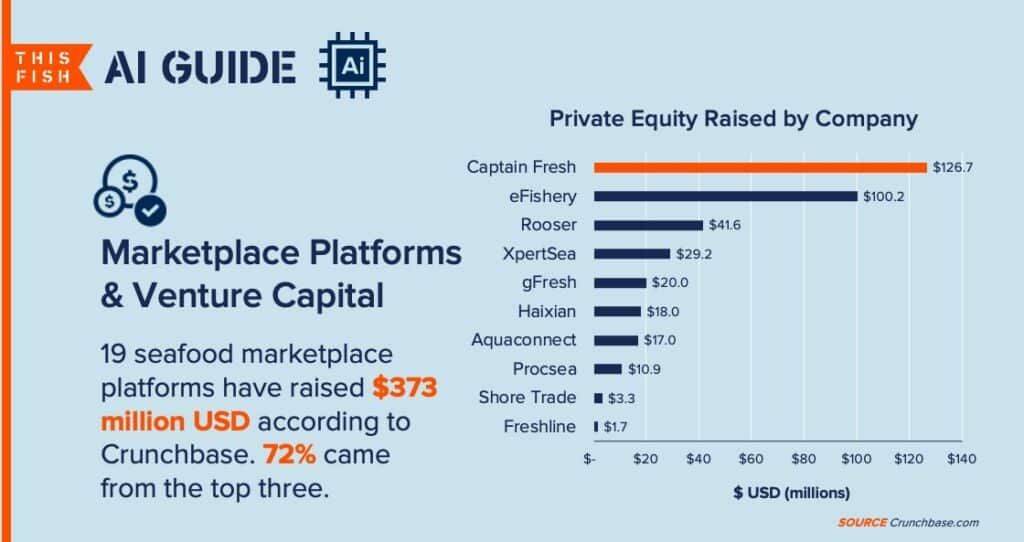

The largest private equity investments in online seafood marketplaces have been in India with Captain Fresh at $126.7 million USD and Indonesia with e-Fishery at $100.2 million USD. In Europe, Rooser has raised $41.6 million and Montreal-based XpertSea has raised $29.2 million USD to finance its growth in Latin America.

For Carol and Bruce Dirom, owners of Hardy Buoys Smoked Fish on Vancouver Island, their online marketplace journey began prior to the pandemic. An enthusiastic customer nudged them online, setting them up with a BigCommerce online shop to sell their shelf-stable salmon jerky.

“I’m happy that we added online jerky sales to our portfolio,” Carol says. “We’re letting it grow organically.” While D2C sales weren’t as strong as expected, they are making headway selling wholesale to other online retailers such as subscription services and gift boxes. “With very little effort, I see results,” Carol explains about her cold calling D2C e-commerce sites.

“With the proper salesperson, we could significantly boost sales,” adds Bruce.

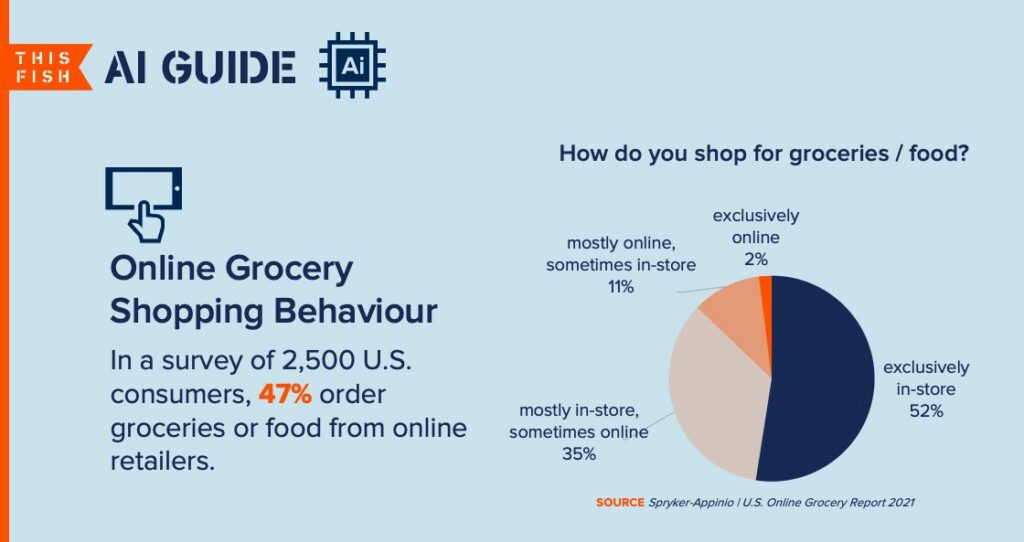

A 2021 U.S. consumer survey points to a growth opportunity. The survey showed that the pandemic forced 47 percent of consumers to order online in the last year. When asked about the next two years, 56 percent say they’ll likely order food online.

Nevertheless, Levin, Kirstiuk and the Diroms all agree that the bigger opportunity for seafood is to push wholesales online. D2C is not for every company, especially smaller ones that need to focus and don’t’ have the marketing acumen to build a large online following.

“There is this idea that vertical integration is ideal,” Levin explains, “but it’s supply chain collaboration that is typically the most profitable and results in better customer service and better products. Instead of having to own everything through the whole supply chain, you really need to look how to work with partners to make sure you are as efficient as possible. So that’s where we’re heading.”

Please sign-up for our monthly newsletter Catch-Up to receive the next post.