Pioneering seafood traceability

On April 22, 2010, at exactly 12:53 Eastern Time, Patrick McMurry, World Champion Oyster Shucker and owner of Starfish Oyster Bar & Grill in Toronto, made social media history. McMurry (aka @ShuckerPaddy) likely made the first-ever post of a traceable fish on Twitter.

It was a momentous event, at least for me. McMurry tweeted a picture of a lingcod tagged with a traceable code and a website link to discover its story. The tweet is still online (click here) although all the links are dead.

The fish had been caught by my cousin Ryan, a groundfish longliner from Vancouver Island. What’s more, I was part of a small team at the nonprofit Ecotrust Canada in Vancouver that had launched this traceability experiment. McMurry’s tweet marked our first market validation. We were elated.

From that simple tweet, we began a journey to build a seafood traceability platform that launched nationwide the following year with Sobey’s, Canada’s second largest grocery chain. The year 2011, in fact, proved pivotal. Several pioneering traceability systems launched besides our own: Pacific FishTrax in Oregon, Gulf Wild in the Gulf of Mexico, and John West Australia with the first traceable canned tuna. Before these initiatives, only Traceall Global and Trace Register had been tracing fish for a few years.

It was a period of experimentation. In the ensuing years, I participated in seafood traceability pilots around the world. At one point, I found myself in the tangled, muddied jungles of the Brazilian Amazon trying to trace mangrove crab. Artisanal fishermen were lathering themselves in engine oil to ward off mosquitos infested with the Zika virus. Scaling these many pilots proved challenging.

The rise of blockchain in traceability

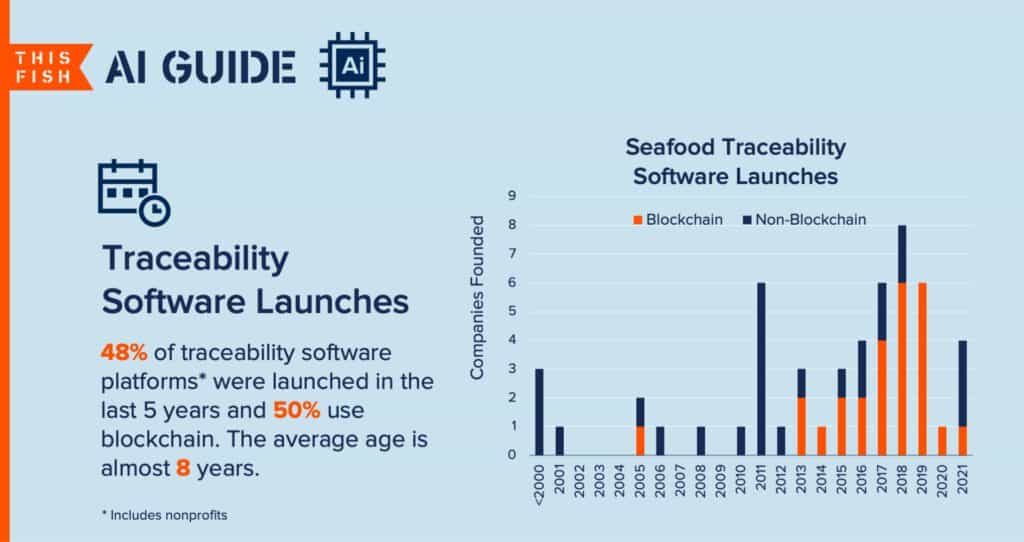

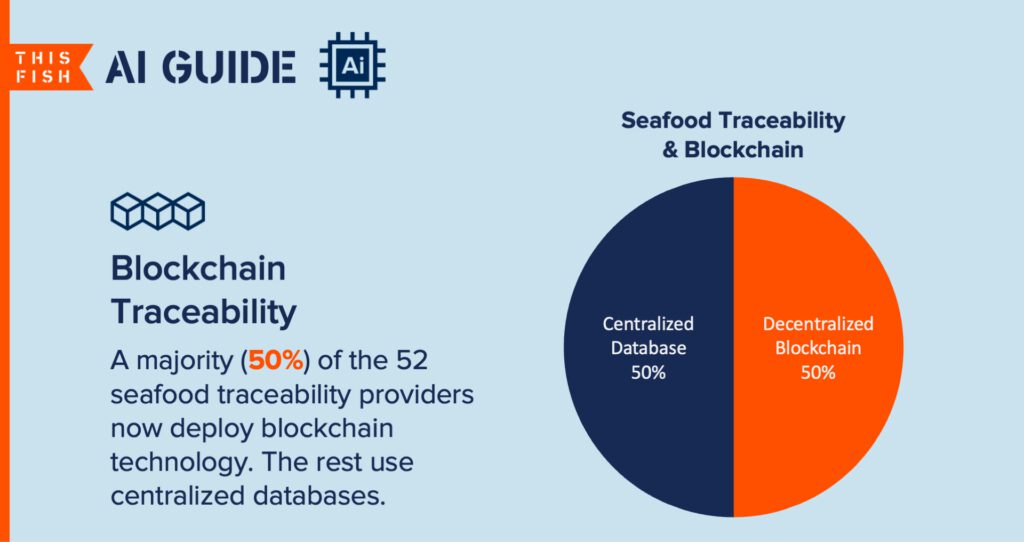

Today, there are 47 companies providing traceability software to the seafood industry* (See footnote.). Much has changed since those nascent days. Indeed, half of these traceability providers have been launched in the last five years alone. And 25 companies are powering traceability with blockchain.

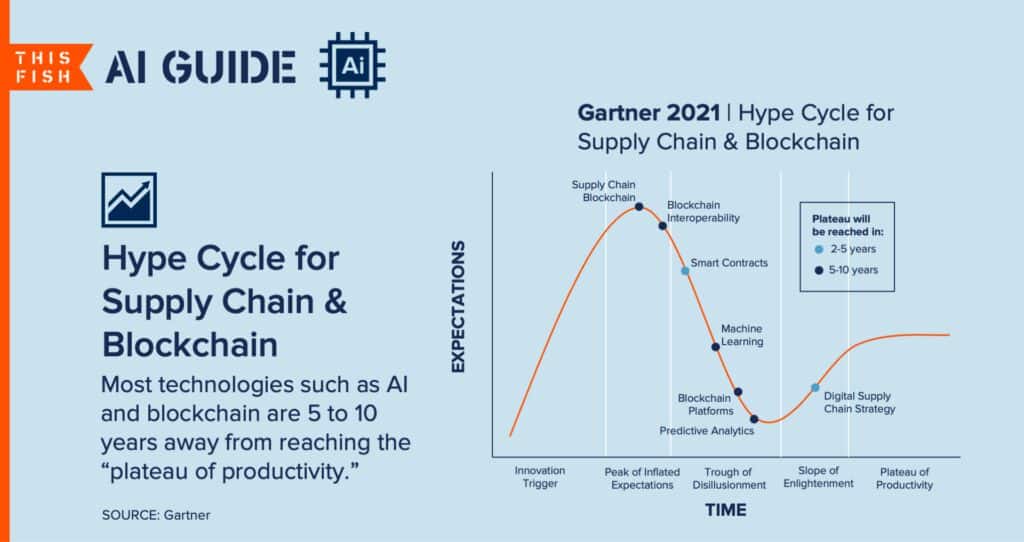

Blockchain hype has certainly driven some traceability adoption in the past few years. Indeed, according to Gartner, blockchain hit the peak of its “Hype Cycle” in 2021.

My own view is that blockchain will have limited value compared to the potential of artificial intelligence. So how many traceability providers offer AI-powered solutions? The answer: only three. I’ll return to this question a little later and describe how AI could help drive traceability adoption.

Market and regulatory drivers of traceability

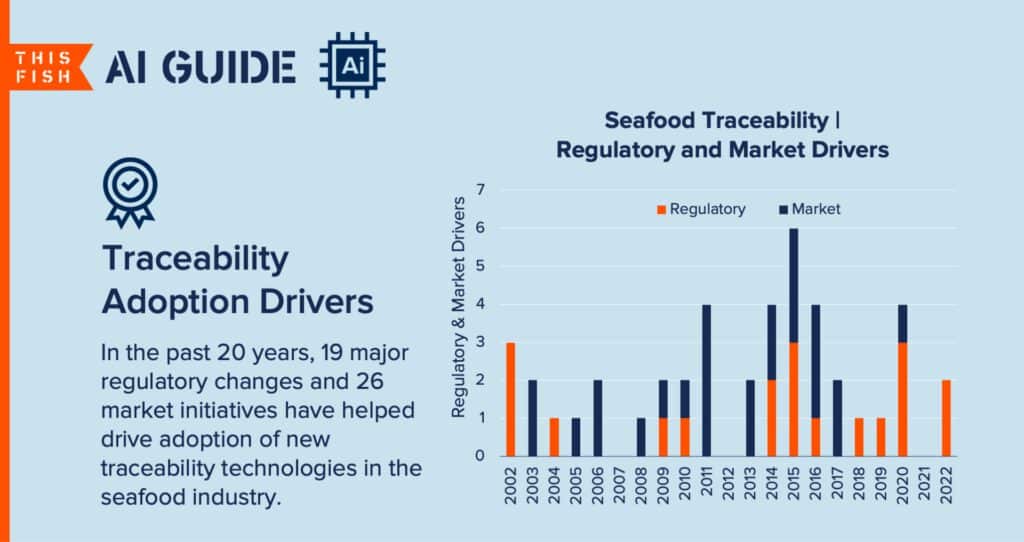

Up until now, the seafood industry has been reluctant to fully embrace electronic traceability. External forces have been pushing change. In the past two decades, there have been 19 major regulator food traceability changes such as E.U. Catch Certificates, U.S. Seafood Importation and Monitoring Program and stricter COOL (Country Of Origin Labelling) laws in various countries. Some 26 market initiatives including new NGOs, certifications, eco-ratings, campaigns, and pilot projects have also been pressing for improved traceability.

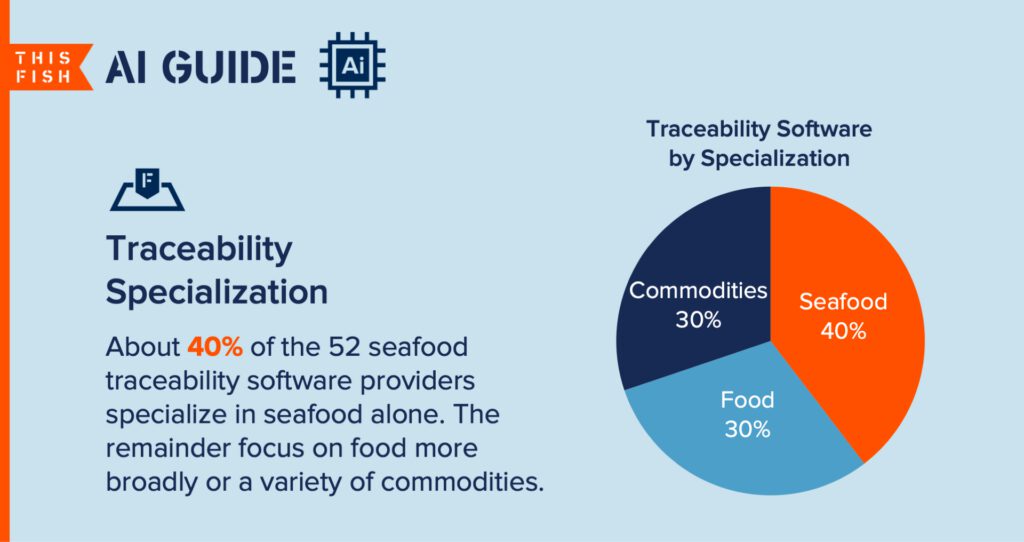

About 42 percent of the traceability providers specialize in seafood, 29 percent focus on food more broadly and 29 percent trace a variety of commodities, such as coffee, chocolate, minerals, timber, palm oil, fashion, etc.

Pandemic accelerates supply chain investment

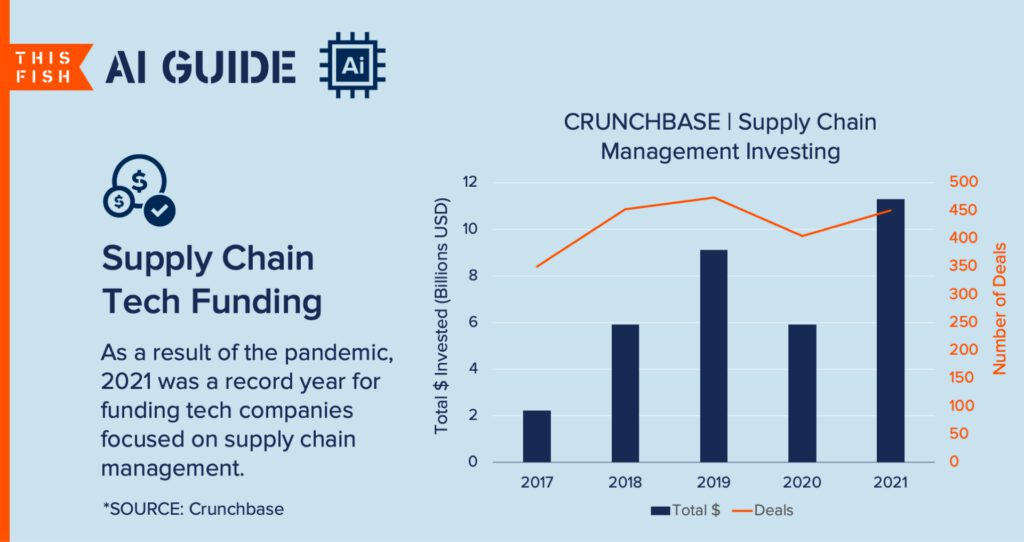

In fact, the pandemic has driven an explosion of investment in supply chain management tech, including traceability. In 2021, Crunchbase reported 450 deals worth 11.3 billion USD.

“No one cared about this space just a few years ago,” Teddie Wardi, managing director at Insight Partners, told Crunchbase. “Not just investors, but I mean, everyone. Now, we have seen about 10 years of transformation in two.”

Functionally, many of these traceability platforms are very similar. Most offer both B2B and B2C (business-to-consumer) traceability and white labelling solutions for branding. And most seem to target mid-stream operators such as processors, distributors, and CPG brands, as their paying customers.

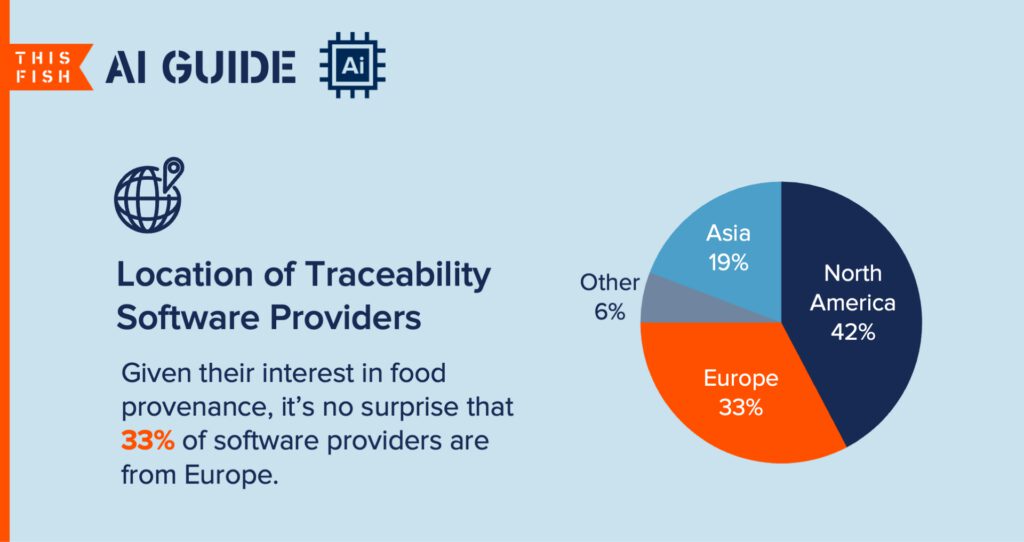

Given Europe’s strong interest in food provenance, it’s unsurprising that some 34 percent of traceability software providers are located there. About 40 percent are in North America and 19 percent in Asia.

Data verification to drive tech differentiation

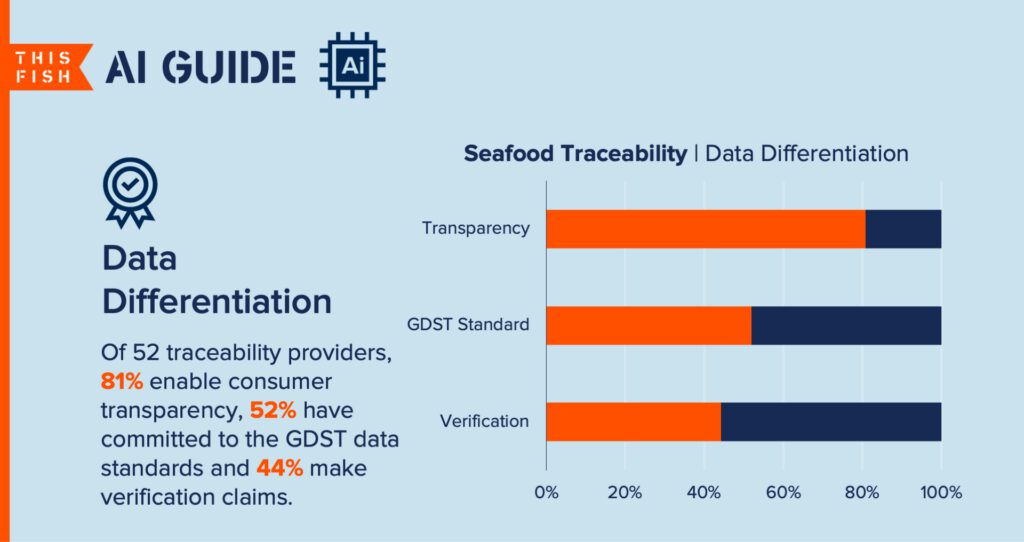

Where we could see growing market differentiation among tech providers is around data. About 55 percent of traceability software providers have committed to the new Global Dialogue for Seafood Traceability data standards and six percent track carbon. Traceability providers are well placed to help track a product’s carbon footprint which is largely determined by its harvest or farm method, transportation mode and distance travelled—all data typically collected for traceability.

In my view, competition is likely to focus on data verification. About 40 percent of traceability providers make a claim about data verification. Boston-based Legit Fish, for example, verifies data electronically against government catch records. EVRYTHNG, which has been working with Mowi, uses an “intelligent digital identity” along with machine learning and analytics. Likewise, OpenSC in Sydney, Australia, uses “immutable” blockchain technology and continuous, automated analysis of data to verify low-carbon and sustainable food. Truthful, accurate and validated data is traceability’s Holy Grail.

In general, manual data entry is more vulnerable to manipulation than sensors and machines automatically collecting or analyzing data. But data verification comes in many forms. Here’s a list from the simplest to most technologically advanced:

- Data linked to digital image of signed physical document

- Data entry linked to verified users, timestamps, and geolocation

- Data automatically collected through sensors or machines

- Data shared through immutable ledger (blockchain) to prevent downstream manipulation

- Data automatically verified through third-party databases for chain-of-custody certificates, catch records or active fishing licences

- Data linked to a unique digital identity attached physically to an item

- Data validated through analysis using standard algorithms, such as mass balance or standard deviation calculations

- Data validated through machine-learning algorithms to catch statistical outliers, such as errors or fraud

Artificial Intelligence critical to data verification

Blockchain doesn’t solve the garbage-in, garbage-out data problem. If fraudulent data is inputted into a blockchain then it just becomes immutable garbage. For more robust verification, I believe artificial intelligence holds incredible promise.

First, traceability data can have commercial value beyond just tracking a product. At ThisFish Inc., we’ve pioneered two machine learning algorithms for yield prediction in a tuna cannery and a salmon processor. We discovered that duration in the cold chain can impact yields by up to three percent. These AI-powered insights could help procurement departments make better buying decisions. Since AI depends on clean, comprehensive datasets, companies will have a commercial incentive to ensure their traceability data is accurate.

Second, AI relies on big data too. The bigger, the smarter is the general rule. Machine learning algorithms basically compare current data to past data, illuminating hidden patterns and trends. In this way, machine learning can be a first line of defense against fraudulent or erroneous data. AI can flag outliers, warning seafood companies that something unusual may be afoot. AI is already widely used for fraud detection with credit cards.

“Predictive Analytics have been deployed in supply chains for dozens of years,” writes Noha Tohamy of Gartner. “Yet many organizations still struggle to point to demonstrable ROI. Adoption is challenged by poor data quality and cultural resistance.”

That is particularly true in the seafood industry where much data is still trapped on paper and supply chain transparency is viewed suspiciously. Seafood companies that embrace digital transformation and supply chain transparency will be well placed to reap rewards.

Traceability needs to be seen not as a compliance cost but as a competitive advantage. Key to this paradigm shift is data. Artificial intelligence may hold the promise to create intrinsic motivation among supply chain operators – especially seafood processors – to collect more and better traceability data if valuable commercial insights can be gleaned from this data. That, in turn, would create the paradigm shift from compliance to competitive advantage and hasten the adoption of electronic traceability globally.

Footnote:

*For the purposes of this analysis, I defined traceability software as connecting two or more operators in a supply chain, including consumers. I did not include e-commerce and online marketplaces. Those will be analyzed in a subsequent article. Furthermore, I only included traceability platforms directly selling, piloting or marketing to the seafood sector.

Please sign-up for our monthly newsletter Catch-Up to receive the next post.