Top 5 Seafood Tech Trends

At the Seafood and Fisheries Emerging Technology conference in Bali, Indonesia on Oct. 2, I presented data and analysis on the global tech ecosystem for seafood and what I think will be the top 5 trends over the next few years.

Before I present my findings, let’s take a look at the data.

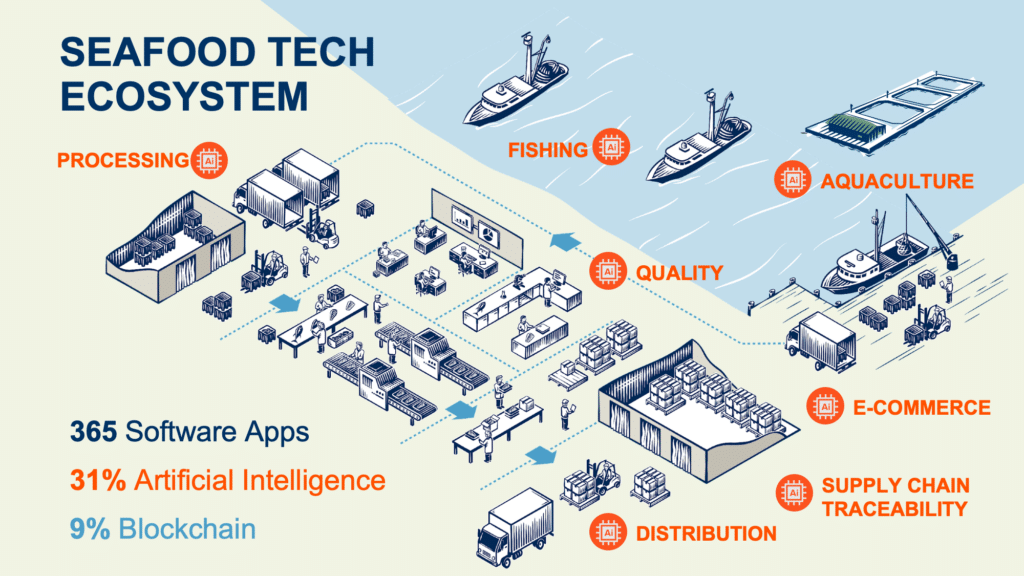

Global Seafood Tech Ecosystem

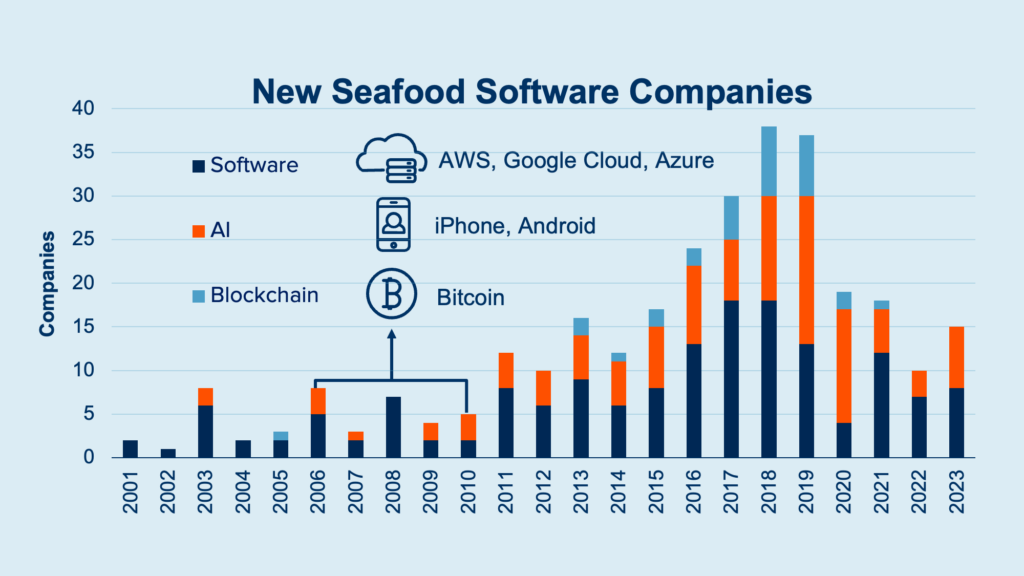

At ThisFish, we’ve analyzed more than 365 software applications used throughout seafood supply chains: fishing, farming, processing, distribution, online marketplaces, quality, etc. (See our online Software Directory). About 31% are using artificial intelligence (AI) and 9% blockchain technology. In 2018-19, the number of new start-ups peaked at around 30 in each of those years.

Three foundational technologies that launched between 2006 and 2010 led to this growth. First, cloud computing with Amazon Web Services (AWS), Google Cloud and Microsoft Azure made computing ubiquitous. Second, the launch of the iPhone and Android put this computing power in the palm of our hands. And third, the launch of Bitcoin started the hype around distributed blockchain technology and cryptocurrencies.

There’s been a dramatic decline of new start-ups over the last two years in seafood. This trend follows the general market pattern as the investment environment has become more trying and as pandemic tech hype has fizzled, especially related to blockchain and cryptocurrencies.

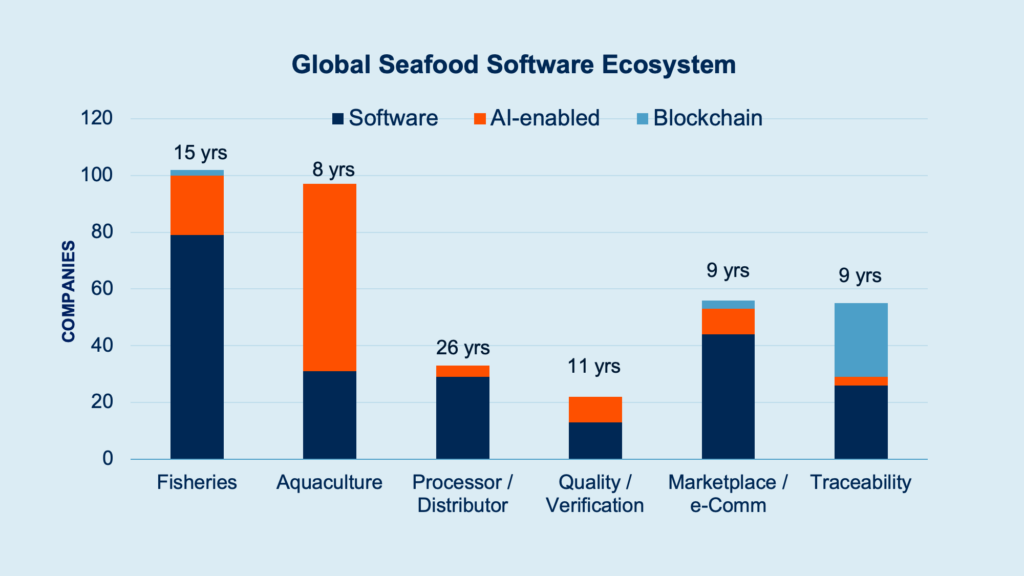

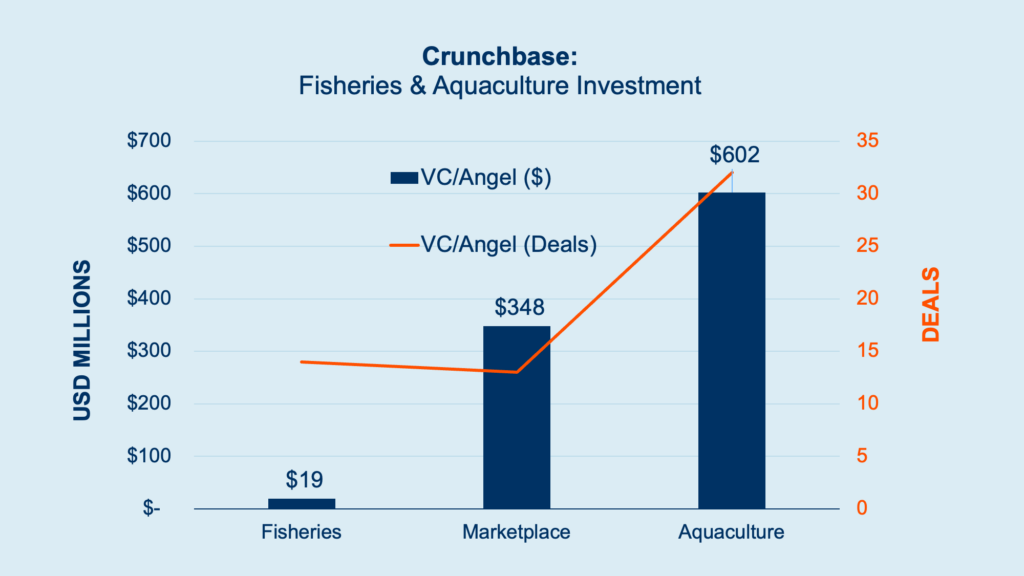

Innovation has also been highly uneven in seafood supply chains. The growth of new aquaculture compared to fisheries companies has been double and the amount of AI in aquatech is almost triple compared to fishtech.

This innovation gap will likely widen over the next few years as the amount of venture capital and private equity in aquatech ($602 million USD) is more than 30 times higher than fishtech ($19 million USD), according to Crunchbase.

So, given some of this growth and investment data, here are my top 5 trends for seafood tech over the next few years.

Tech Trend 1: Mergers & Acquisitions

There are hundreds of new companies in the seafood tech space, some well capitalized and some not. With fewer new companies being launched, I expect to see more mergers and acquisitions as well capitalized companies buy up poorly capitalized companies and as older, legacy companies accelerate their innovation by buying early stage companies. Private equity may also see supply chain synergies and begin to purchase tech companies with complementary and connected offerings. I’ve chatted with a few private equity firms that are looking to build an integrated seafood tech portfolio.

Tech Trend 2: Platform Business Models

One of the biggest tech adoption challenges in seafood supply chains is how to digitize primary producers, especially small-scale fishers and farmers. Fishcoin, one of the earliest initiatives, tried to incentivize producers through free cellular data in exchange for their digital data. Montreal-based XpertSea attempted to build sophisticated AI tools for small-scale shrimp farmers. Ultimately, these strategies didn’t work.

What does appear to be working is to incentivize primary producers to digitize their data to access online marketplaces, a strategy that XpertSea pivoted to. These businesses are often called double-sided platforms, since they are made up of producers and consumers, sellers and buyers.

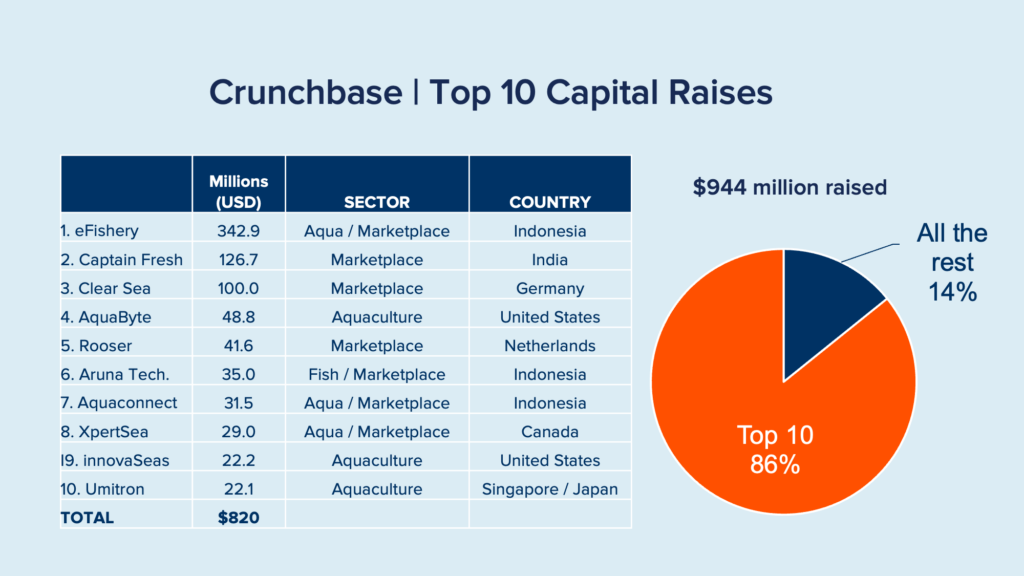

In fact, 7 of the 10 most well capitalized seafood tech companies are platform businesses including eFishery ($342.9 million USD), Captain Fresh ($126.7 million USD), Clear Seas (100.0 million USD), Rooser (41.6 million USD), Aruna Technology ($35.0 million USD), Aquaconnect ($31.5 million) and XpertSea ($29.0 million USD). These companies are offering a blending of technological and financial solutions, enabling online brokering, financing, and trading of seafood.

Given the amount of capital invested—more than $706 million USD and growing—these platforms are likely to drive supply chain digitization in the future.

Tech Trend 3: Artisanal Artificial Intelligence

As our annual Fish n’ Chips Index shows, the price of fish, according to the FAO Fish Price Index, has risen by 60 percent since 1990 while the price of semiconductors or computer chips has decreased by 50 percent while becoming exponentially more powerful.

AI is no different: in the past few years, the rise of large-language models (LLMs) such as ChatGPT has shocked us all with their ability to mimic human intelligence. Machine translation, such as DeepL.com, has become ridiculously accurate too. Organizations such as OpenAI—which built ChatGPT—are trying to build artificial “general” intelligence or AGI. Meanwhile, others are commercializing “universal” models, such as facial recognition which is now ubiquitous. These AI approaches benefit from massive economies of scale.

However, as cloud computing and software development becomes more affordable, new smaller scale approaches are becoming financially feasible. Welcome to the world of artisanal AI.

One of the best examples is Sivam Krish, CEO and Co-Founder of Adelaide-based GoMicro. Krish developed a small lens that attaches to a smartphone to take micro-images. Computer vision algorithms then classify the freshness of fruits, nuts, grains, meat and fish. Krish told me GoMicro only need a few hundred images to train a model, and can develop new models at lightning speed.

We’re taking a similar approach at ThisFish, building affordable infrastructure that will allow us to automatically retrain, test and deploy AI models, such as yield prediction in fish processing. Manually doing these tasks by a data scientist would typically cost thousands of dollars, which most small enterprises can’t afford.

Artisanal AI is about building boutique algorithms for specialized challenges and deployed at a small scale. It’s about democratizing technology.

Tech Trend 4: Internet of Things (IoT) Sensors

Sensors are becoming smaller, better, and cheaper. AI also requires a lot of data, which will help to drive further growth in the future. Moreover, IoT sensors, by automating data collection, can significantly improve the quantity and quality of data, since it removes human error. Temperature, humidity, vibration, water quality, geolocation, CCTV cameras, hyperspectral imagery, satellite imagery—sensors are now everywhere and many aren’t much larger than a thumb nail.

By way of example, at ThisFish Inc., we recently launched TallyTag, a remote, wireless temperature sensor that operates on LoRaWAN or a long-range, wide-area network that enables the small tag to transmit data up to 15 km. LoRaWAN is an ideal network for IoT, since it operates on free public radio frequencies making it low cost and highly scalable.

Tech Trend 5: Globally Ubiquitous Satellite Internet

One word: Starlink. Operated by Elon Musk’s aerospace company SpaceX, Starlink is a satellite Internet constellation providing coverage to over 60 countries. High speed Internet is now almost a reality everywhere, all the time, from the high seas to the high Arctic. This is making technology more accessible and affordable, especially for rural and remote areas. Starlink is having far reaching consequences for deploying and operating technology globally.