The pandemic has created a “new normal” in more ways than one. Two fundamental changes in consumer behaviour have irrevocably emerged because of COVID-19. Seafood companies that proactively respond to these seismic shifts will reap rewards in the form of increased customer loyalty, higher margins and a diversified customer base. In short, they’ll grow revenue. Unfortunately, most seafood processors aren’t currently wired to turn crisis into opportunity.

That’s because they have barely even begun their journey of digital transformation which is going to be key to success in the future. The pandemic has forced many manufacturers to accelerate their spending on digitization or what is called Industry 4.0.

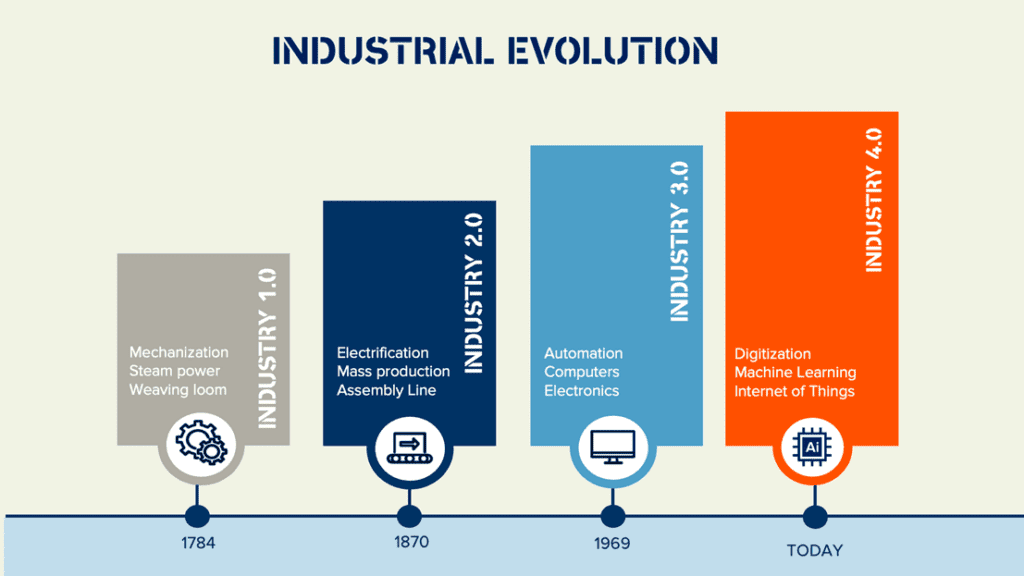

Industrialization began in 1784 with the invention of the steam engine (Industry 1.0) followed by electrification (Industry 2.0) and computer electronics in 1969 (Industry 3.0). Today, we’re experiencing the transformation to Industry 4.0.

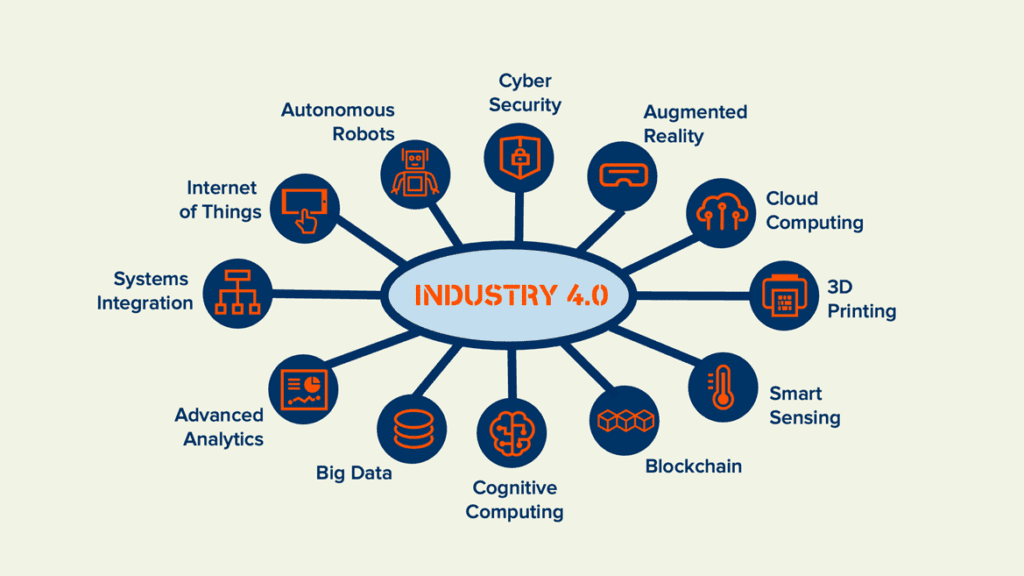

What does Industry 4.0 involve? At its heart are digital technologies: autonomous robots, cognitive computing, big data, blockchain, cloud computing, Internet of Things, augmented reality, smart sensing, and other advances.

Several indices measure a company’s digital readiness which typically focuses on operations, infrastructure, people, and leadership. I’ve evaluated several of these online self-assessments, including the Digital Readiness Level, Emerson Digital Maturity Index, and Impulse Digital Readiness Self-Check. They’re usually on a scale of 1 to 6. Most seafood companies are at the lowest level with manual processes, paper records and no digital transformation strategy. The industry is lagging.

But the pandemic has now created a “new normal” that is going to drive digital transformation over the next decade. Seafood companies can ignore it at their peril.

First, a growing number of consumers are demanding more transparency from their favoured brands and retailers. “Transparency throughout the supply chain will dominate in 2021, with consumers searching for brands that can build trust, provide authentic and credible products, and create shopper confidence in the current and post-COVID climate,” says Lu Ann Williams, Director of Insights and Innovation at Innova Market Insights, which published its top-ten trends for 2021.

Many brands and retailers are now adopting blockchain technology to share trusted data with their customers using QR codes, which has seen widespread consumer adoption thanks to the pandemic. While seafood hasn’t adopted transparency as readily as fashion, coffee, chocolate and other foodstuffs, there has been strong growth in the number of traceability technology providers, many powered by blockchain. Some of the top providers, in alphabetic order, include:

- Atato | First MSC-certified canned tuna traced on blockchain

- DigiFresh | Providing traceability technology to Niceland Seafood

- Evrythng | Providing supply chain solutions to Mowi

- Fishcoin | Pioneering blockchain traceability with small-scale producers

- fTrace | Initiative of GS1 Germany focused on European market

- IBM Food Trust | Providing traceability to Ecuador’s Sustainable Shrimp Partnership

- LegitFish | Launched in New England’s fisheries

- OpenSC | A partnership between WWF and the Boston Consulting group

- Provenance | An early blockchain provide is working with Princes on canned tuna

- Quillhash | Blockchain traceability in several sectors including seafood

- TE-FOODS | Blockchain traceability with a presence in Europe and Southeast Asia

- Trace Register | The pioneer and one of the largest traceability providers to US retailers

- Traseable | Piloting traceable tuna from the South Pacific

- Vericatch | Launched KnowYour.Fish

- Wholechain | Piloting blockchain in Dungeness crab and Fair Trade shrimp

Increased transparency builds consumer trust and, along with strong marketing and storytelling, can lift a brand’s social cache earning it higher prices. Seafood is a commodity, subject to price sensitivity from gluts and shortages in supply. However, building a trusted brand powered by cutting-edge traceability technology can generate premium prices.

The second seismic shift has been the explosive growth in online grocery shopping. “COVID-19 massively accelerated trends that we were already seeing—it packed a decade of e-commerce growth into a single year,” reports Shopify, the e-commerce platform for business. “Homebound consumers dramatically changed their shopping behavior, and millions of businesses were forced to invest more heavily in their existing e-commerce channels or go online for the first time.”

According to a global survey across 11 markets by Shopify, 84 percent of consumers shopped online during the pandemic. The result was that in 2020, food and beverage became the largest online consumer packaged goods (CPG) segment at 44 percent, higher than beauty and fashion. Total online sales of food and beverage 125 percent from the previous year, to $106 billion, according to research from the Food Industry Association (FMI) and NielsenIQ.

With the collapse of restaurant and food service business during the pandemic, many seafood processors pivoted to direct-to-consumer (D2C) or experienced explosive growth in their online shops ushing e-commerce platforms such as Shopify. Tech start-ups are also building apps to facilitate and automate online D2C and B2B transactions. Some of the top innovators include:

- Fresh Captain | A B2B platform for seafood in India

- Freshline | Formerly seafood-focused Coastline, an online app for fresh food sellers

- JET Seafood Portal | A B2B seafood platform based in Norway

- KnowSeafood | Online D2C shop based in New England

- Lota | A platform for D2C seafood sales in Portugal

- PeskyFish | A UK-based marketplace for seafood

- ProcSea | A French-Swiss platform to automate buying and selling of seafood

- SaleFish.io | Software to automate online sales, marketing and ordering

- Seafood Souq | An online global marketplace for seafood

- Shore Trade | An online marketplace for B2B seafood sales

- Tuna Solutions | An online auction for tuna

- xpertSea | The shrimp-tech startup has pivoted to a farmer-buyer platform

- Yorso | Online app for the wholesale fish and seafood businesses

At ThisFish Inc., we are seeing a growing demand to integrate our Tally software to these e-commerce platforms to automate fulfillment processes on the factory floor, especially as companies scale from hundreds of wholesale customers to thousands of D2C consumers.

Whether its supply chain transparency powered by blockchain or the need to diversify through e-commerce, digital transformation is going to be key to the next generation of seafood companies. Competition is going to get fiercer as more plant-based proteins and cell-cultured seafood enter the market. The FAO Fish Price Index is forecasted to fall by two percent by 2029. That’s going to create more pressure on seafood processors to diversify, strength their brand integrity and generate efficiencies through digital transformation.